The POS Dashboard

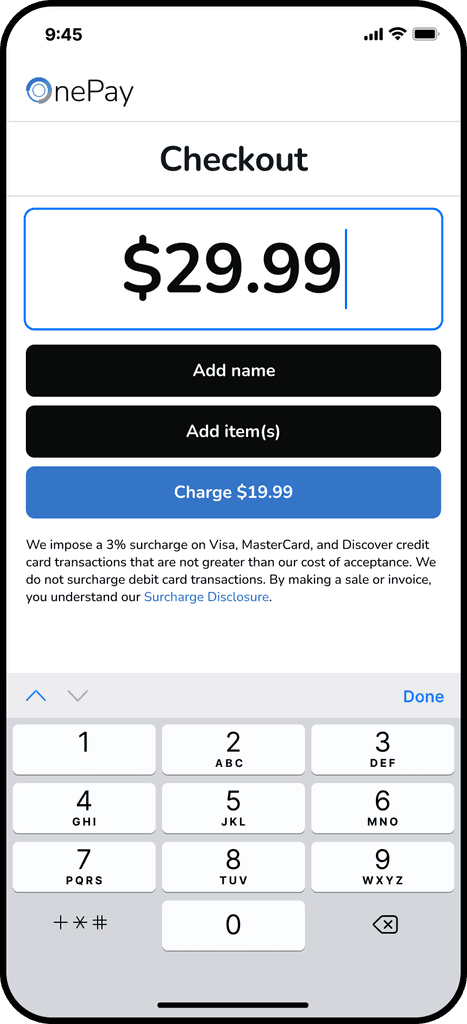

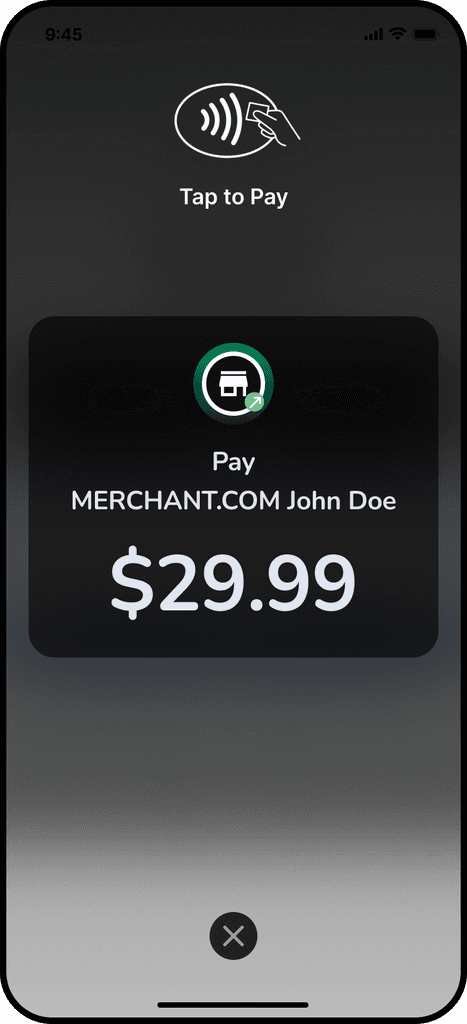

Making it easier to accept payments

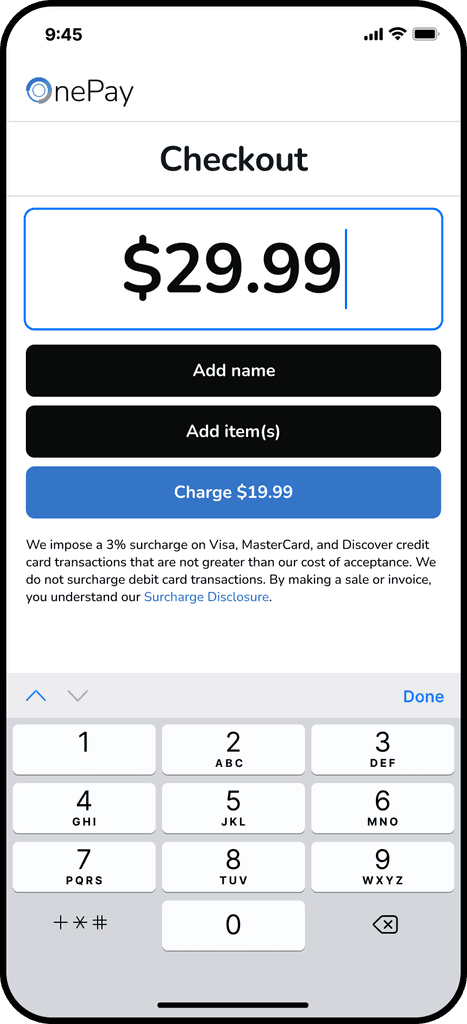

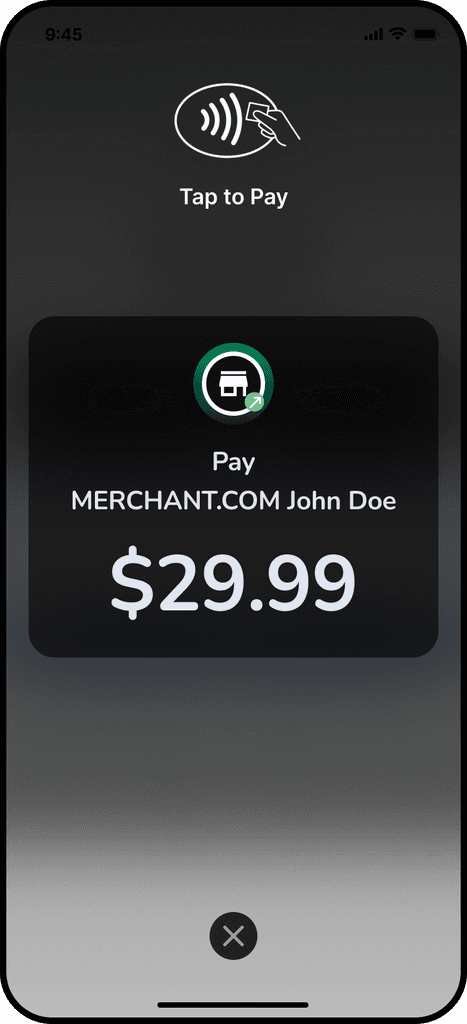

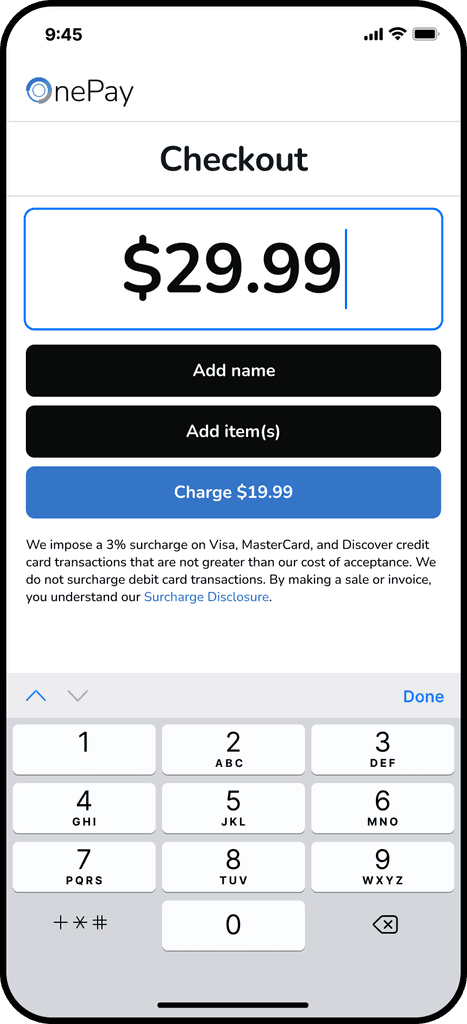

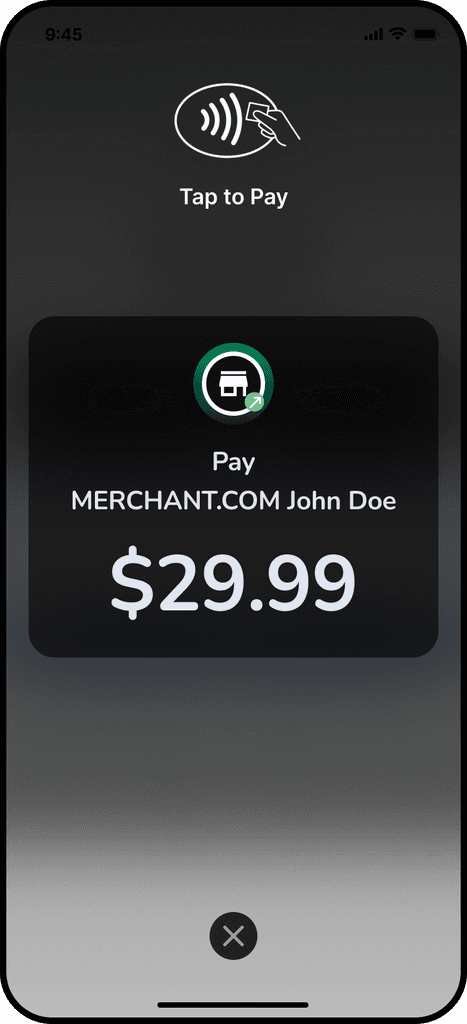

The Point-of-Sale (POS) dashboard is designed to give everyone the ability process payments while giving users a hands-on, easy-to-use experience. It allows new merchants to quickly jumpstart their business and customize their POS dashboard to reflect their brand and customer preferences.

Role

Product Designer

Client

Venetian Las Vegas (VLV)

Responsibilities

UI/UX Design

System Design

Prototyping

Team

Candy Brown-Proctor (Project Manager)

Sadan Ahmed (Engineer)

Rizwan Mohammad (Engineer)

The POS Dashboard

Making it easier to accept payments

The Point-of-Sale (POS) dashboard is designed to give everyone the ability process payments while giving users a hands-on, easy-to-use experience. It allows new merchants to quickly jumpstart their business and customize their POS dashboard to reflect their brand and customer preferences.

Role

Product Designer

Client

Venetian Las Vegas (VLV)

Responsibilities

UI/UX Design

System Design

Prototyping

Team

Candy Brown-Proctor (Project Manager)

Sadan Ahmed (Engineer)

Rizwan Mohammad (Engineer)

The POS Dashboard

Making it easier to accept payments

The Point-of-Sale (POS) dashboard is designed to give everyone the ability process payments while giving users a hands-on, easy-to-use experience. It allows new merchants to quickly jumpstart their business and customize their POS dashboard to reflect their brand and customer preferences.

Role

Product Designer

Client

Venetian Las Vegas (VLV)

Responsibilities

UI/UX Design

System Design

Prototyping

Team

Candy Brown-Proctor (Project Manager)

Sadan Ahmed (Engineer)

Rizwan Mohammad (Engineer)

Problem

LV needed a POS system that would enable them to seamlessly onboard new merchants and set up fees and charges. However, they couldn't find any existing software solutions that allowed them to customize their fees and charges efficiently. This lack of customization made it challenging for them to collect their share, manage payments to their payees, and maintain a personalized experience for their merchants' brand and customers' preferences.

Previously, they were using Square's POS dashboard, and manually splitting their fees and charges for each transaction in the back-end, which not only consumed a lot of time for them but also made it prone to human errors.

VLV needed a customizable POS system that enabled them to split funding to their payees, but there weren't any software solutions out there that that allowed them to do that. This made it difficult for our clients to manage payments to their payees while personalizing towards their brand and customers. Previously, they were using Square's POS dashboard while manually splitting funds to their payees in the back-end, which made it time-consuming and prone to human errors.

The decision to build a POS dashboard and funding manager in an all-in-one interface was based on several factors, including the overall business goals of our clients.

1

Streamlined Workflow: By integrating the POS dashboard and Funding Manager into one interface, users can seamlessly manage their sales and financial information without switching between different platforms and manually disbursing payments to their payees.

Streamlined Workflow: By integrating the POS dashboard and Funding Manager into one interface, users can seamlessly manage their sales and financial information without switching between different platforms and manually disbursing payments to their payees.

2

Real-Time Data Sync: When a transaction is completed, the sales data can be immediately processed within the Funding Manager, ensuring accurate financial information for split funding distribution.

Real-Time Data Sync: When a transaction is completed, the sales data can be immediately processed within the Funding Manager, ensuring accurate financial information for split funding distribution.

3

Efficiency: Once a transaction is closed, Funding Manager is the solution that can automatically allocate the amounts owed to each payee based on predefined rules or percentages, saving users the manual effort of calculating and distributing funds separately. This is all done by our in-house engineering team to release the stress from VLV and bring them back more time in their hands.

Efficiency: Once a transaction is closed, Funding Manager is the tool that can automatically allocate the amounts owed to each payee based on predefined rules or percentages, saving users the manual effort of calculating and distributing funds separately.

Results

After working closely with engineering to bring the designs to life, we launched the test and crossed our fingers. At the project’s launch, we documented two primary indicators of success; streamlined fund distribution and centralizes data for easy access. Fortunately, our users found the experience more efficient than ever before.

We achieved an 80% reduction in time and cost by eliminating manual work through the Funding Manager. Only 20% of the time was spent on initial setup for predefined amounts and percentages to payees. We also lifted satisfaction by retaining our user's ability to customize their POS while eliminating the burden of managing split funding.

A win of this magnitude meant pushing out the designs from testing to public release, benefiting all VLV users, associated stakeholders, and potential future clients seeking to integrate OnePay into their daily business operations.

VLV needed a customizable POS system that enabled them to split funding to their payees, but there weren't any software solutions out there that that allowed them to do that. This made it difficult for our clients to manage payments to their payees while personalizing towards their brand and customers. Previously, they were using Square's POS dashboard while manually splitting funds to their payees in the back-end, which made it time-consuming and prone to human errors.

©2023 Keenan Srisaeng. All rights reserved.

©2023 Keenan Srisaeng. All rights reserved.

©2023 Keenan Srisaeng. All rights reserved.